What is Cropty Crypto Loan?

Cropty Crypto Loan is a secure, overcollateralized, and flexible loan product. Users can take loans by pledging their crypto assets as collateral. With Cropty, you don't have to worry about rehypothecation since we don't lend out your collateralized crypto to others.

Unlock Endless Possibilities

With Cropty's Crypto-Backed Loans

Big Buys Made Easy

Why not put that cash to work? Renovate your pad, get that shiny new ride, fund your education, or treat yourself to the vacation of your dreams.

Tax-Smart Moves

By using your Instant Crypto Credit Line, you can dodge taxable events that might happen when selling your digital assets. Smart, huh?

More Crypto, More Fun

Double down on your crypto game! Collateralize your existing assets, and invest in other digital goodies, stocks, gold, or even real estate.

Boost Your Biz

Grow your business without parting ways with your crypto. Cover those pesky operational costs, keep your employees happy, or seize that once-in-a-lifetime opportunity.

Real Estate Ventures

Diversify into real estate, snag your dream home, invest in rental properties, or fund home improvements – faster than traditional lenders.

Debt-Busting

Wave goodbye to high-interest credit card debt and simplify your life with just one loan. Plus, no credit checks required!

Crypto Loan Calculator

Crunch the Numbers and Discover Your Loan Potential

USDT

Interest rate

15% per year

Mounthly Interest Amount

-

Quarterly Interest Amount

-

Yearly Interest Amount

-

FROM $1 TO $1M

Available for borrowing

80% LTV

High Loan-to-Value (LTV) Ratios

Instant Approval & No Credit Checks

Enjoy a hassle-free application process with instant approval and no invasive credit checks, making it easy for anyone to access our Crypto Loans.

Flexible Repayment Terms

Experience true financial freedom with our flexible repayment terms, including no monthly repayments, no statement deadlines, and no late fees, letting you repay at any time without penalties.

Secure Custody & Storage

Trust our robust security measures, including custody secured by Ledger Enterprise, to keep your crypto assets safe throughout the lending process.

Zero Hidden Fees

Save more with Cropty's transparent fee structure – no transaction fees, no origination fees, and no hidden charges, ensuring a cost-effective lending solution.

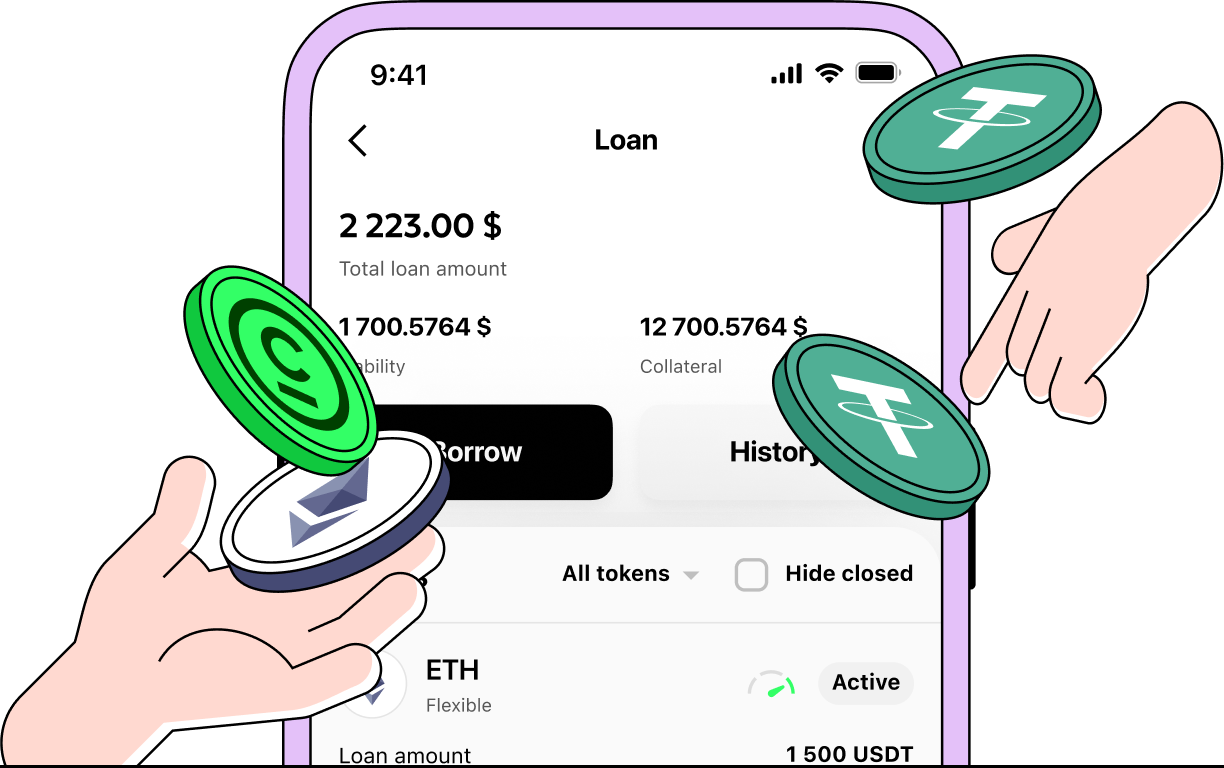

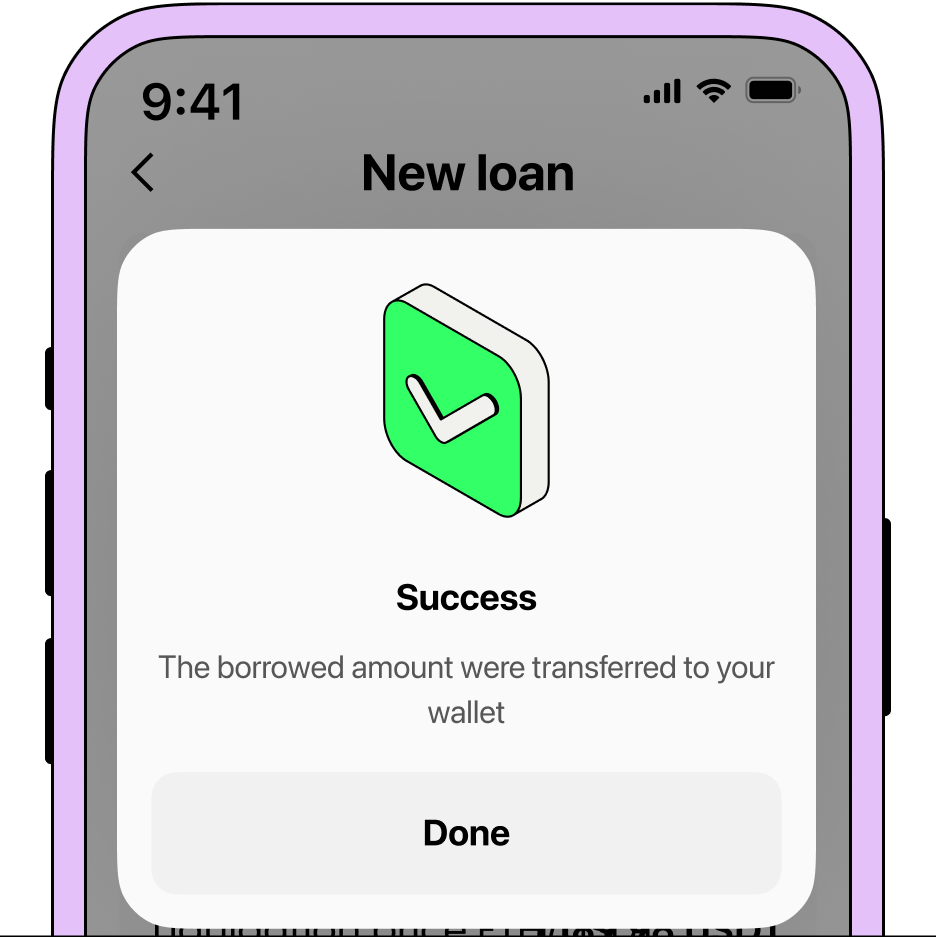

How to Get Started

Deposit Crypto Collateral

Fund your wallet with the cryptocurrency you plan to use as collateral for your loan.

Create Your Loan

Navigate to the "Features" tab, then "Loans", and open a new loan by selecting your collateral and desired loan amount.

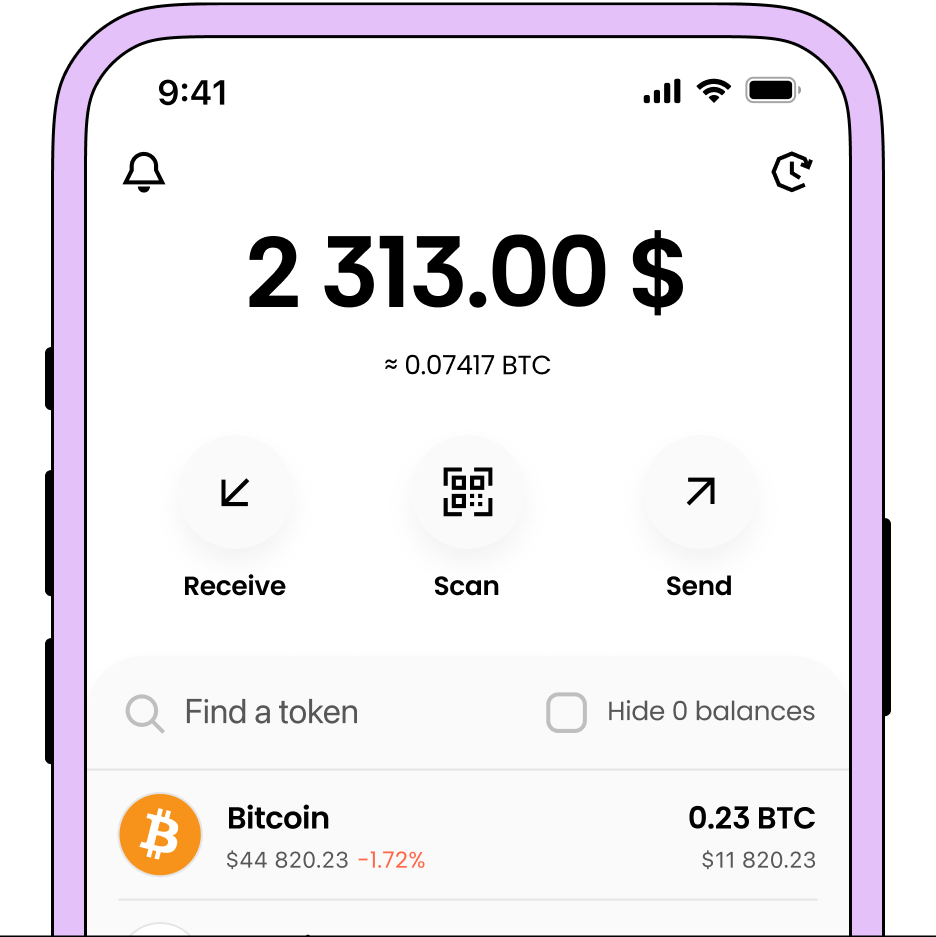

Instant Funding

Receive the loan amount in your wallet instantly, and use the funds however you please.

What is Cropty Crypto Loan?

Crypto Loans at Cropty, or loans backed by cryptocurrency, are a type of financial service that allows borrowers to obtain funds instantly by using their digital assets as collateral. Cropty's unique approach enables individuals to access liquidity without having to sell their cryptocurrencies, thus avoiding potential tax implications or loss of future appreciation.

Here's a step-by-step breakdown of how Crypto Loans work at Cropty:

Register on Cropty

First, you need to create an account on the trusted and reputable Cropty platform, which offers instant Crypto Loan services.

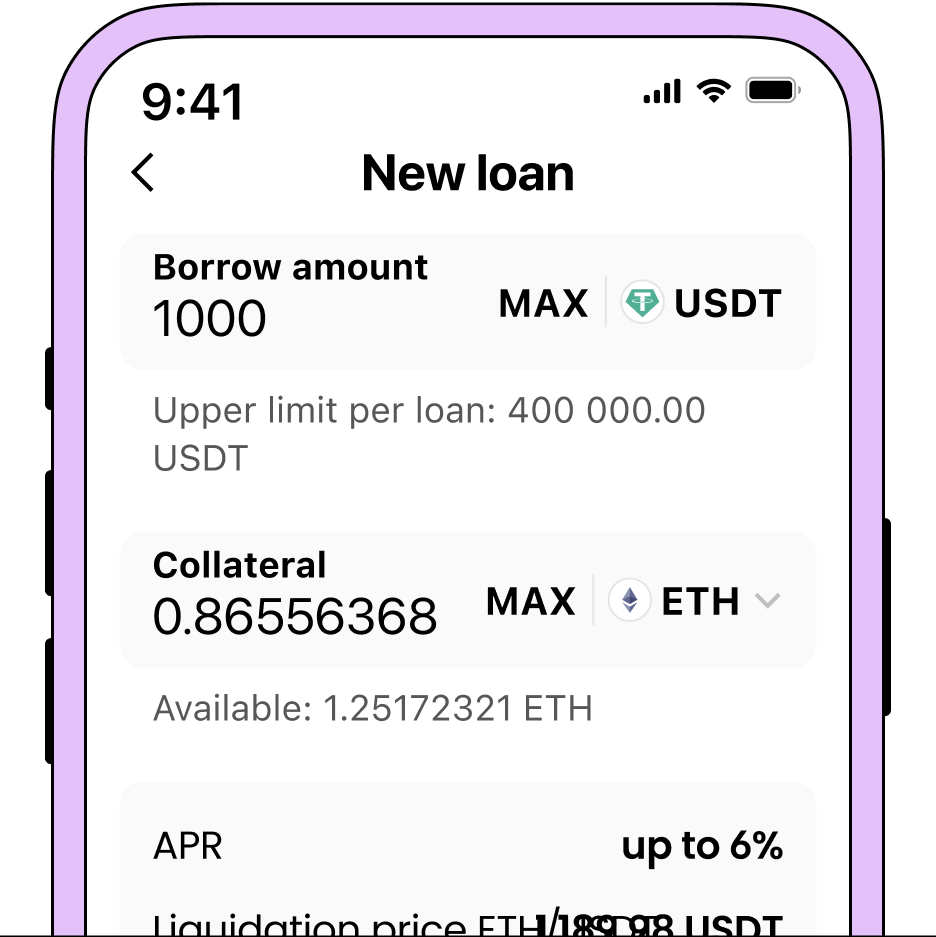

Deposit collateral

To obtain a Crypto Loan, you must deposit an amount of cryptocurrency as collateral. Cropty will securely store your digital assets for the duration of the loan. The amount of collateral required will depend on the Loan-to-Value (LTV) ratio, which is the proportion of the loan amount relative to the value of the collateral.

Loan approval

Once your collateral has been deposited, Cropty will assess the LTV ratio and instantly approve the loan without any credit checks, making it accessible for a wide range of borrowers.

Receive funds

After loan approval, you'll receive the funds in your designated account. Cropty only provides loans in the form of USDT (Tether), a stablecoin pegged to the US Dollar.

Flexible interest payments

During the loan term, you're not required to make regular interest payments. Instead, interest accrues over the loan duration, providing you with flexibility in managing your financial obligations.

Loan repayment

You can repay your loan at any time without incurring penalties. Once you've returned the borrowed USDT amount plus any outstanding interest, your collateral will be released back to you.

Defaulting and liquidation

If the value of your collateral falls below a specified threshold, Cropty may issue a margin call, requesting that you deposit additional collateral to maintain the LTV ratio. If you're unable to meet the margin call, Cropty may liquidate a portion or all of your collateral to recover the loan amount and any outstanding interest.

Crypto Loans at Cropty provide a flexible and instant financing solution for individuals looking to leverage their digital assets without having to sell them. As more people recognize the potential of cryptocurrencies and their role in the global financial ecosystem, Cropty's innovative financial product continues to gain popularity.

Crypto loans vs Conventional Loans

Instant Crypto Loans

Conventional Loans

Boost Your Crypto Game

Cropty's Crypto Loans let you level up your crypto portfolio without having to sell your assets, giving you more flexibility and growth potential.

Instant Crypto Loans

Conventional Loans

Yes

No

Lower Rates, More Savings

Enjoy competitive interest rates with our Crypto Loans, saving you money compared to traditional loans.

Instant Crypto Loans

Conventional Loans

Yes

No

Skip the Origination Fees

Don't sweat the small stuff – our Crypto Loans have no origination fees, so you can focus on what really matters.

Instant Crypto Loans

Conventional Loans

Yes

No

Keep It Tax-Friendly

Make the most of tax-efficient solutions by opting for our Crypto Loans, avoiding potential tax consequences that may come with selling your crypto.

Instant Crypto Loans

Conventional Loans

Yes

No

Ditch the Monthly Repayments

Break free from mandatory monthly repayments with our flexible repayment terms, letting you repay when it suits you best.

Instant Crypto Loans

Conventional Loans

Yes

No

No Waiting, Just Instant Approval

Get started right away with Cropty's instant approval process, skipping the long waiting times associated with conventional loans.

Instant Crypto Loans

Conventional Loans

Yes

No

Say Goodbye to Paperwork

Embrace a paperless and hassle-free application process with our Crypto Loans, making it easy for anyone to apply.

Instant Crypto Loans

Conventional Loans

Yes

No

Keep Your Credit Score Untouched

Our Crypto Loans don't impact your credit score, ensuring your financial reputation remains in good shape.

Instant Crypto Loans

Conventional Loans

Yes

No

Collateral Freedom

From Bitcoin to altcoins, our diverse range of supported assets provides you with the freedom to choose the perfect collateral for your loan

Bitcoin

Get $51397 for 1 BTC

Ethereum

Get $2527 for 1 ETH

Dogecoin

Get $121 for 1000 DOGE

Aave

Get $718 for 10 AAVE

Avalanche

Get $287 for 10 AVAX

Binance USD

Get $801 for 1000 BUSD

Bitcoin Cash

Get $386 for 1 BCH

BNB

Get $486 for 1 BNB

Cardano

Get $381 for 1000 ADA

ChainLink

Get $119 for 10 LINK

Chiliz

Get $948 for 10000 CHZ

Cosmos

Get $676 for 100 ATOM

Cronos

Get $101 for 1000 CRO

Dai Stablecoin

Get $804 for 1000 DAI

Decentraland

Get $368 for 1000 MANA

EOS

Get $708 for 1000 EOS

Ethereum Classic

Get $211 for 10 ETC

Filecoin

Get $480 for 100 FIL

Flow

Get $742 for 1000 FLOW

Huobi Token

Get $464 for 1000 HT

Immutable X

Get $176 for 100 IMX

Litecoin

Get $670 for 10 LTC

Maker

Get $2280 for 1 MKR

NEAR Protocol

Get $544 for 100 NEAR

OKB

Get $435 for 10 OKB

Polkadot

Get $557 for 100 DOT

Polygon

Get $569 for 1000 MATIC

Quant

Get $859 for 10 QNT

Ripple

Get $423 for 1000 XRP

SHIBA INU

Get $201 for 10000000 SHIB

Tezos

Get $804 for 1000 XTZ

The Sandbox

Get $369 for 1000 SAND

TON Coin

Get $397 for 100 TON

Tron

Get $913 for 10000 TRX

TrueUSD

Get $801 for 1000 TUSD

Uniswap

Get $620 for 100 UNI

USD Coin

Get $801 for 1000 USDC

VeChain

Get $317 for 10000 VET

Zcash

Get $184 for 10 ZEC

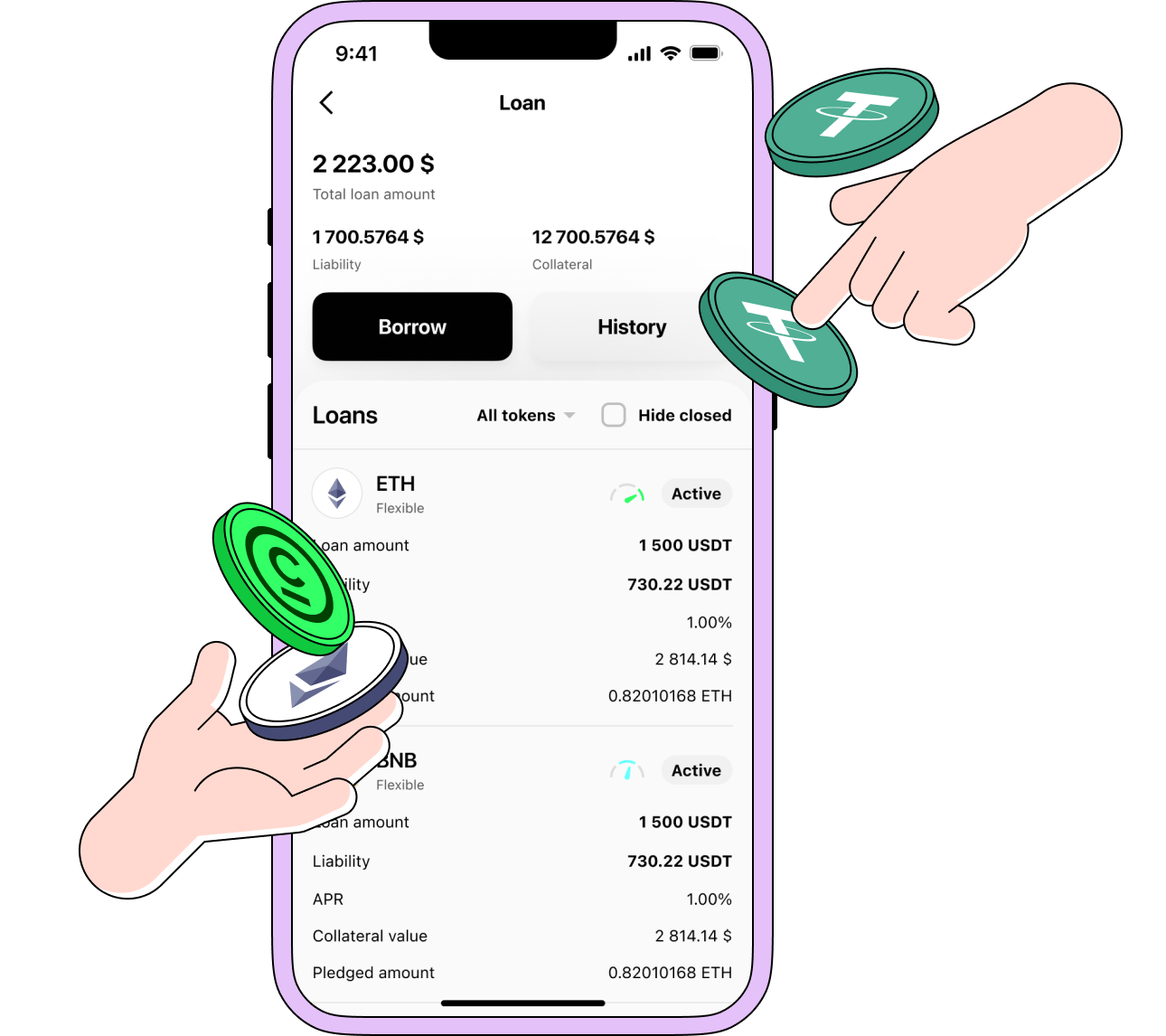

Track Your Loan in a Wild Crypto World

Cropty's got your back in the ever-volatile crypto market, helping you keep a close eye on your loan's health and stay in control with some cool features:

Margin Call Heads-Up

Crypto market got you on your toes? No worries! We'll send you timely margin call alerts, so you know when it's time to top up your collateral or repay a part of your loan.

LTV at a Glance

With our super visual LTV indicators, you can effortlessly keep tabs on your Loan-to-Value ratio, making smart decisions on the fly.

Repay or add Collateral Whenever

Flexibility is the name of the game. Top up your collateral or make additional payments anytime to dodge liquidation and keep your loan secure.

Don't let market swings catch you off guard. Stay safe and in control with Cropty's advanced loan management tools.

Useful articles:

Discover what a crypto flash loan is, how they work, learn what are the main use cases, and how people make money with it.

Discover what crypto lending is and why you may want to use it and learn about crypto loans without collateral, including flash loans

Discover what crypto lending is, how it works, and what are the advantages of crypto loans, learn about the crypto lending risks and how to avoid them.

Discover what is a crypto credit card and what are the top options available on the market, learn about the benefits of crypto credit cards and reasons to get one.

Learn what a crypto lending platform is and what are the best options available, discover how crypto loans work and how users benefit from using them

Learn what crypto lending is and how it works, discover why most crypto lending platforms require collateral, and check out examples of crypto loan use cases

FAQ

What is Cropty Crypto Loan?

Cropty Crypto Loan is a secure, overcollateralized, and flexible loan product. Users can take loans by pledging their crypto assets as collateral. With Cropty, you don't have to worry about rehypothecation since we don't lend out your collateralized crypto to others.

How do I pledge my assets and start borrowing with Cropty Crypto Loan?

To start, choose the crypto you'd like to pledge as collateral and the amount you'd like to borrow. Ensure you have sufficient crypto assets in your account to cover the required collateral. Once the process is complete, your collateral will be locked, and the loan will be transferred to your account.

What is LTV, and how much can I borrow from Cropty Crypto Loan?

LTV (Loan-to-Value) represents the ratio between the value of the loan plus accrued interest and the value of your collateral. The LTV percentage determines how much you can borrow based on the collateral you pledge. For example, with a 50% LTV, if you pledge 1,000 USDT, you may borrow up to 500 USDT worth of assets.

Are there limits to how much I can pledge and borrow?

Yes, there are limits for each cryptocurrency. The maximum amount you can pledge or borrow depends on the specific crypto and may change periodically.

What is loan liquidation, and what is the liquidation LTV?

Loan liquidation occurs when the current LTV exceeds the liquidation LTV, which may happen if the collateral's value decreases or the loan's value increases. If liquidation occurs, you may lose some or all of your collateral.

What happens when a loan is liquidated?

When liquidation occurs, the outstanding loan amount will be repaid using the equivalent value of collateral. A partial liquidation happens when the liquidation doesn't fully cover the outstanding loan, and a full liquidation occurs when the entire loan is repaid using the collateral.

What is a margin call?

A margin call is a warning issued when your collateral-loan pair position reaches its margin call LTV. You can take action by adding more collateral or reducing the outstanding loan to lower the LTV.

Will I be notified in the event of margin calls or liquidations?

Yes, Cropty will send notifications via email and SMS in case of margin calls or liquidations. However, timely delivery of these notifications cannot be guaranteed.

What interest rate applies to my loan?

Cropty provides transparent interest rates for each cryptocurrency. Please refer to the platform for up-to-date interest rates.

How is interest accrued for my loan positions?

Interest accrues based on the total outstanding loan amount and the prevailing APR. The interest accrued is added to the total outstanding loan.

How do I repay my loan or adjust my LTV?

Use the 'Repay' or 'Adjust LTV' options in your account to repay loans or adjust collateral, respectively. You can only repay your loan using the same cryptocurrency you borrowed.

Which cryptocurrencies can I pledge or borrow on Cropty Crypto Loan?

Cropty Crypto Loan accepts a variety of cryptocurrencies as loanable and collateral assets. The list of available cryptocurrencies is updated periodically, so please refer to the platform for more information.

What can I do with the cryptocurrencies borrowed from Cropty Crypto Loan?

You can use the borrowed cryptocurrencies for various purposes, including trading, investing, or withdrawing from the platform. The collateral you pledge remains with Cropty as security for the repayment of your loan.

Can't find the answer to your question? Visit our support center